Today, 94% of women believe their economic power is being underestimated. (We have a hunch that Barbie, Beyoncé, and Taylor would agree.)

Case in point? When asked who would benefit most from the Great Wealth Transfer — which will put tens of trillions of dollars in the hands of women over the next few decades, and result in women owning the majority of wealth in the US — just 17% of men said it would be women. (And less than half of women surveyed — 42% — thought it would be women.)

These stats come from the Ellevest Women and Wealth Survey 2024: Great Wealth Transfer, a nationwide survey of more than 2,000 affluent people across the US and across generations.*

Our findings show that, in addition to people significantly underestimating how much women’s economic power is set to grow through the Great Wealth Transfer, we are also not prepared for the seismic changes that it could usher in. Changes for women, of course. And for everyone who does business with women, and whose customers are women, and who's funded by women, and who's raised by women, and who's related to women. By this measure, the Great Wealth Transfer has the potential to reshape society — and society’s beliefs about women and wealth — and will affect us all … whether or not you’re a recipient of a financial windfall.

And what will we call this newfound phase of economic power? The Feminization of Wealth.

Our survey has identified both the challenges that may prevent affluent women from making the most of their wealth during this historic moment, and what it'll take to overcome those hurdles. The good news is that our stats show it’s well within women’s financial power to do so.

What is the Great Wealth Transfer?

Baby Boomers have built a historically unmatched amount of wealth. They were the beneficiaries of a booming economy, robust markets, and price appreciation of their homes for most of their lives. As they die, that wealth gets passed on. Primarily to women. And more specifically, first to Boomer wives, who tend to live longer than their husbands. And after that, to their children: Gen X and Gen Z will receive some, but the much larger Millennial generation — with a record number of single women — may end up with most of it.

How significant is this for women?

Of the women we surveyed, 45% either had received or expected to receive a financial windfall, the typical amount being around $300K. For many, that’s a life-changing amount of money. And these stats may under-count the impact of the Great Wealth Transfer, given that a much higher percentage — 73% of people surveyed — believed they would be able to leave an inheritance.

What may be even more important than these numbers is a fundamental shift that occurs when women receive a financial windfall: Their money confidence improves.

How significant is this boost in financial confidence?

It’s so significant that it completely wipes out women’s well-documented money confidence gap

. Receiving a financial windfall increases women’s confidence 1.8 times — from 45% reporting that they’re confident with money, to 81%. And it means that they become more confident about their ability to manage their money than even men are (at 77%).

What this points to: It’s not that women have less money because they have less confidence, as so many assume. Instead, it's the gender wealth gap itself — women having less money — that drives the money confidence gap. And the very act of getting a windfall, or expecting a windfall, is enough to wipe this out.

It’s so significant that it obliterates the long-held taboos around women talking about money

. 77% of women giving or receiving a financial windfall say they're comfortable talking about money with their families. This holds across generations, upending internalized money taboos.

It’s so significant that it propels women to leave relationships that no longer serve them

. About 1/4 of women who have received or expect to receive a financial windfall say they're likely or very likely to leave their partner when or if they receive a financial windfall. That’s ~2x more than women who don’t expect to get a financial windfall.

This response was most prominent with women from younger generations — 33% of Gen Z and Millennial women who have received or expect to receive a financial windfall — and it could be linked to how receiving a transfer of wealth makes women feel. More Gen Z and Millennial women stated that receiving a financial windfall would make them (or made them) feel “powerful” versus women from older generations.

What will women do with their financial windfalls?

Short answer: Whatever they want. (Because that increasing financial confidence will kick in.)

Longer answer:

The numbers for the Great Wealth Transfer are so large that women have the opportunity to reshape broad swaths of our society. That’s in part because women with agency over their own money simply spend and invest their money differently than men do. For example, women with more money can give more money to politicians who share their values; women with more money can give more money to non-profits that align with their values (such as fighting climate change and supporting families); women with more money can invest more money for positive impact.

MacKenzie Scott (formerly MacKenzie Bezos, divorced) is donating her money to non-profits that align with her values, while her ex-husband amasses more wealth and goes to space in a suggestively shaped rocket. Laurene Powell Jobs (widowed) founded Emerson Collective to support social entrepreneurs and organizations working in education and immigration reform, social justice, journalism, and conservation. Melinda French Gates (divorced) founded Pivotal Ventures to invest in accelerating social progress and equality; she has a particular focus on investing in the underrepresented (and is an investor in Ellevest).

More tactically, once they get the money, women say they’re likely to make investing a financial windfall their top priority. Snapping at its heels: putting that financial windfall in the bank.

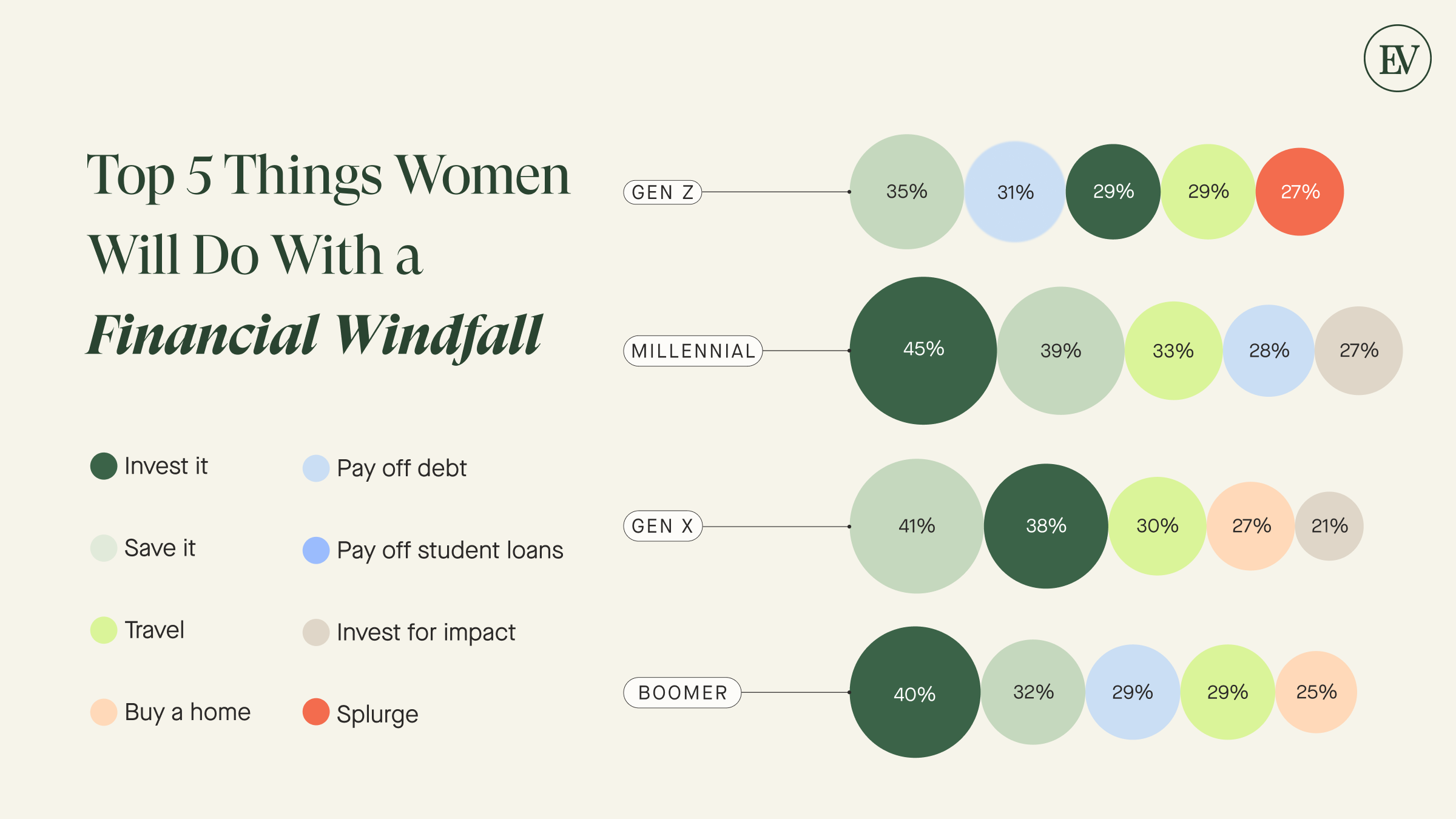

Now those top two responses — invest it and put it in the bank — toggle between ranking first and second depending on the generation. Gen X women (41%) and Gen Z women (~35%) would put their financial windfalls in the bank, whereas Boomer women (~40%) and Millennials (45%) would invest their financial windfalls.

“Travel” ranks as a top-three priority for what to do with a financial windfall across generations, while “pay off debt not including student loans” featured in Gen Z and Boomer women’s highest priorities (and made it in Millennial women’s top five).

“Invest for positive impact” ranked among the top five priorities for all generations except for Gen Z women, who ranked splurging and paying off student loan debt as higher priorities — two money moves we approve of when it comes to deciding what to do with a lump sum of money, btw.

Gen Z women

Put it in the bank (35%)

Pay off debt not including student loans (~31%)

Invest it / Travel (both 29%)

Splurge (27%)

Pay off student loan debt (18%)

Millennial women

Invest it (45%)

Put it in the bank (39%)

Travel (33%)

Pay off debt not including student loans (28%)

Invest for positive impact (27%)

Gen X women

Put it in the bank (41%)

Invest it (38%)

Travel (30%)

Buy a home (27%)

Invest for positive impact (21%)

Boomer women

Invest it (40%)

Put it in the bank (32%)

Pay off debt not including student loans / Travel (both 29%)

Buy a home (25%)

Invest for positive impact (19%)

This is … a lot. And much of it’s good. Where’s the bad news?

Women with financial windfalls don’t have the financial support they need.

Just 38% of women say they have a financial advisor who can help them navigate a financial windfall. And only about half of women know where to go with a financial windfall vs 72% of men. (This skews toward younger women, with just 40-45% of Gen Z and Millennial women knowing where to go vs 62% of Boomer women.)

When women do reach out to the wealth management industry, 65% of Gen Z women — and close to 50% of Millennial women — say they want to work with a woman financial advisor; but they don’t see themselves reflected there. (No wonder, according to a prior Ellevest survey, exactly 0% of women think the financial services industry was built with them in mind.)

What can women do to make the most of their financial windfalls?

Be a woman with a plan. You don’t have to decide what to do with a financial windfall right away. But having a plan — even if it’s “don’t do anything with my financial windfall for one month” — can be a gamechanger when it comes to hitting your money goals for your life and legacy. Research shows that people with a financial plan have 2.7x the net worth of those who don’t.

Having a plan is even more powerful for your overall wellness.

But what if you just don’t know what to do with your financial windfall? Once that one-month-of-doing-nothing plan is up, don’t leave that money in the bank. The answer is still to have a plan. At this stage, to have a plan to speak to a financial planner or financial advisor who can help you take control of your money. Because when you feel like you’re in control of your money, you feel like you’re in control of your life.

And it really does work like that: Our survey results show that the money confidence gap between men and women shrank if a woman was working with a financial advisor. And confidence held across generations. This goes to show that it doesn’t matter what age you are, what life milestones you’re at, whether you’re giving or receiving generational wealth (or you’re not). Having a financial plan — and believing that you can act on it — are how women will make the most out of their money, especially during the Great Wealth Transfer.

We can’t wait to see how the Feminization of Wealth unfolds.

Join us for a live webinar, Future Proofing Your Family’s Wealth: Next-Gen & Inheritance Planning, on March 14, 2024 to learn more about the immediate steps to take today to be prepared for a future financial windfall.

Get financially prepared:

If you would like to learn more about Ellevest Wealth Management, how we help our clients build their wealth, and our values-aligned investment strategy, you can schedule a call with us here.

If / when the time comes for you to receive a financial windfall

, trust that you’ll be a woman with a plan. Ellevest’s experts can help you put your money to work — through a Comprehensive Planning for Inheritance package — and put your mind at ease.

Book a complimentary call with an Ellevest financial planner to get personalized next steps — and learn more about the best things to do with a lump sum of money.

Survey Methodology: Censuswide conducted research on behalf of Ellevest, between February 2 and February 7, 2024 among 2,041 people ages 18–69 with a $150,000+ salary or $750,000 net worth, in the United States. Individuals were compensated between $2.00 - $4.00 for their responses and participation in the Survey.

© 2024 Ellevest, Inc. All Rights Reserved.

Survey Methodology: Censuswide conducted research on behalf of Ellevest, between February 2 and February 7, 2024 among 2,041 people ages 18–69 with a $150,000+ salary or $750,000 net worth, in the United States. Individuals were compensated between $2.00 - $4.00 for their responses and participation in the Survey.

All opinions and views expressed by Ellevest are current as of the date of this writing, are for informational purposes only, and do not constitute or imply an endorsement of any third party’s products or services.

Information was obtained from third-party sources, which we believe to be reliable but are not guaranteed for accuracy or completeness.

The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal, investment, or tax advice.

The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.

Investing entails risk, including the possible loss of principal, and past performance is not predictive of future results.

Ellevest, Inc. is a SEC registered investment adviser. Ellevest fees and additional information can be found at www.ellevest.com.