You did it! You took the leap, got a place together, and two people’s finances are about to become one. (Or, at least, more “one” than they were before.) Grocery budget? Shared. Internet bill? Shared. Housing costs? Shared (thank goodness).

But … shared how? This leads to one of the most common questions we get about money and relationships here at Ellevest: What’s the best way to split expenses with your partner? Especially if one person makes more money than the other? (Which … you know … happens sometimes. Most couples will never be at the exact same career level, let alone on the same career path. And then that wage gap thing can affect some couples, too.)

There are a few ways to do it, and there’s no one “right” answer. You could just split everything 50-50 and call it a day. But if your incomes aren’t anywhere close to equal, one person may be putting entire paychecks toward shared bills, while the other has a lot of extra money to spend. (You know, the whole equality ≠ equity thing.) And that could add unnecessary stress to the relationship.

Or you could go the second-simplest route, and both throw 100% of both your paychecks into a joint account and then pay all the bills from there. But then your partner will see everything you buy (consider: no birthday surprises) and have (consider: financial infidelity), and vice versa.

Fortunately, those aren’t your only options. Our favorite expense-splitting approach for married (or otherwise partnered) couples makes things as fair as possible for everyone: Each person pays the same percentage they make. Let’s explain.

Splitting bills based on income: the step-by-step

Here’s how it works: You keep your individual bank accounts, but also open a joint checking account as a couple. You’ll use this joint account to pay your shared bills. Then, the math:

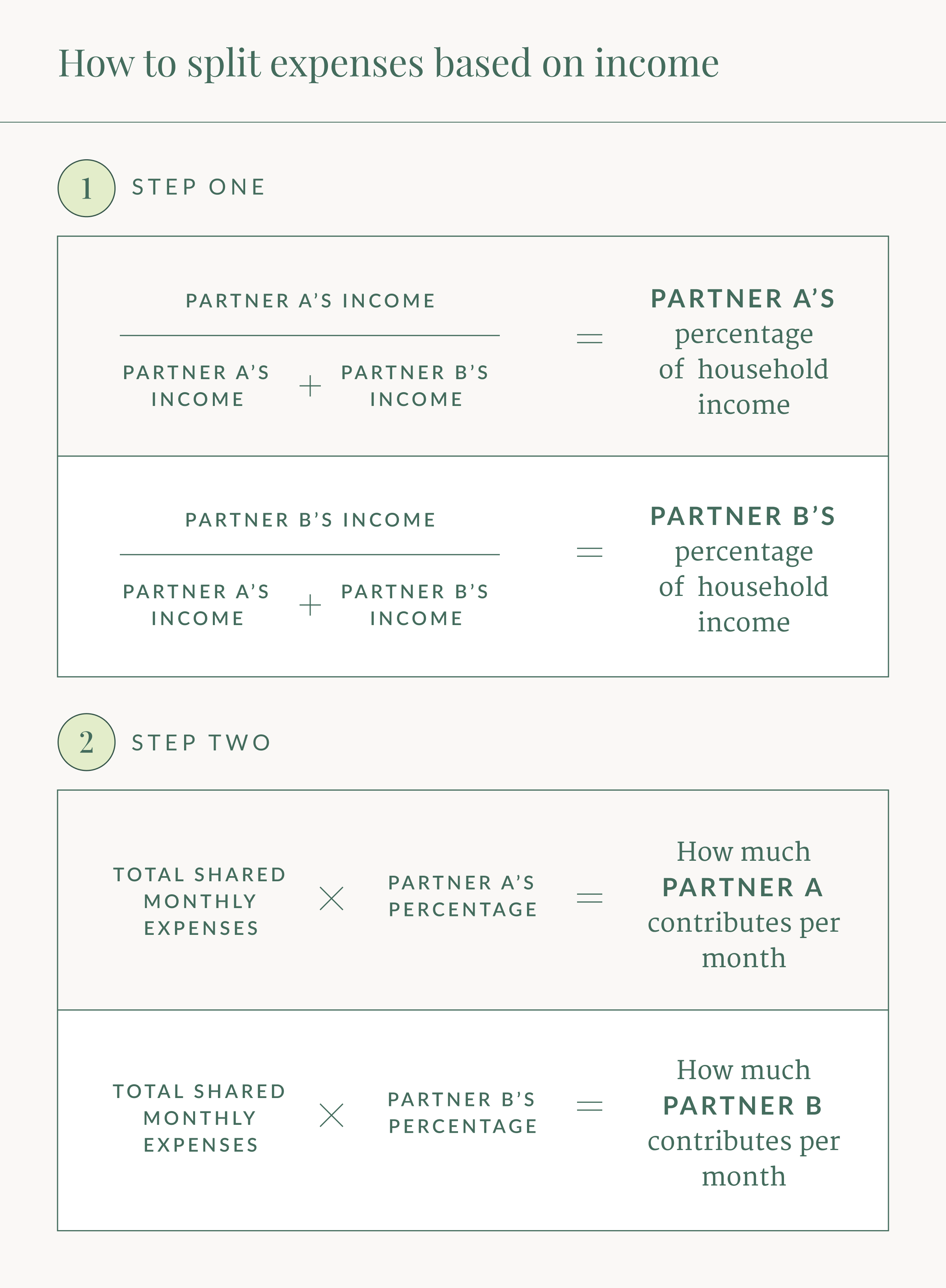

Add up your total household income. Then calculate the percentage of that total each individual partner / spouse makes.

Now add up your total monthly shared expenses (rent / mortgage, utilities, groceries, joint investing or saving goals, etc). Then multiply that total by each of those two percentages from step one to calculate how much each of you should contribute.

Every month, both partners transfer their share into the joint account. (You could also do the transfers every payday, in which case you’d divide your individual share by however many times you get paid each month.) Whatever you have left in your individual account is yours to do with what you will; same goes for your partner.

If you don’t want to do a joint checking account, you can, of course, also go the classic roommate route and just request the calculated amounts from each other, depending on whose name is on the bill. But a third account makes it easier, not only to limit how many times you have to (remember to) transfer to once or twice a month, but also to not accidentally spend your bill money.

The example: a 60/40 split

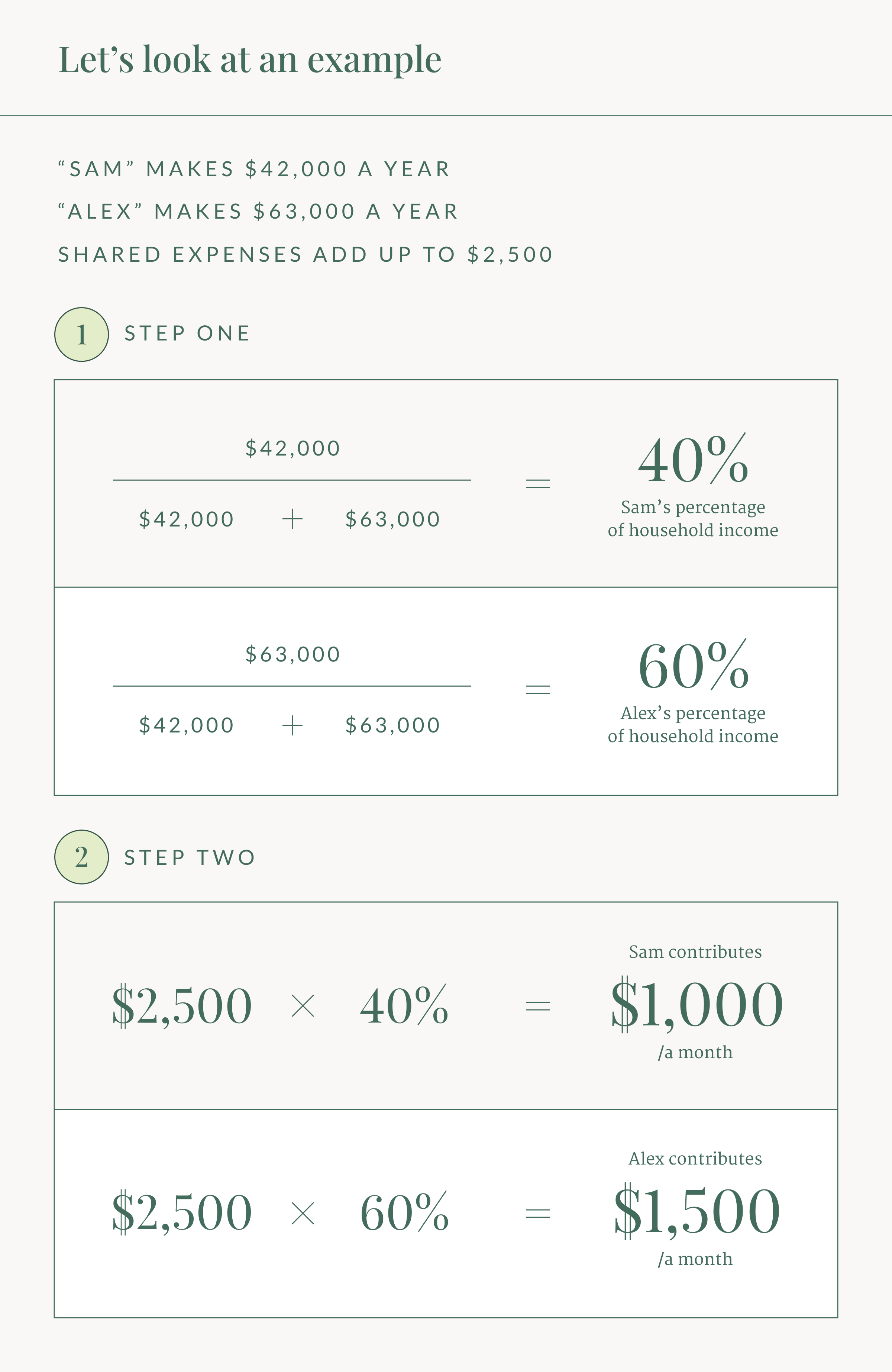

Say “Sam” makes $42,000 a year and “Alex” makes $63,000 a year. That’s a total household income of $105,000. The math:

Sam’s portion of total household income: $42,000 / $105,000 = 40%

Alex’s portion of total household income: $63,000 / $105,000 = 60%

60/40. Easy! Then let’s say their shared monthly expenses add up to $2,500. (We heard that “Lol, in this economy?” snort. Listen, we’re just trying to keep the math simple.)

Sam’s portion of shared expenses: $2,500 x 40% = $1,000 per month

Alex’s portion of shared expenses: $2,500 x 60% = $1,500 per month

Let’s assume they each get paid twice a month. Sam puts $500 from each paycheck into the joint account to reach $1,000 a month, and Alex puts in $750 from each paycheck to reach $1,500 a month. Et voilà! The bills are covered.

Contrast that with a 50/50 split, where Sam would end up paying $1,250 a month — about 36% of a $42,000 salary — while Alex’s $1,250 would only be about 24% of their $63,000 salary. So one person would be paying over a third of their income, and the other would be paying less than a quarter of theirs. Not so fair after all.

The next step: Customize your plan

You can tailor this approach to your own relationship by choosing what is and is not a “shared” expense. If you want a place to do all this math for yourself, Ellevest has a worksheet that can help you get organized (pssst — it’s free for members).

For example, maybe you only share the expenses that “belong” to you both, like rent, utilities, groceries, child care, and streaming subscriptions. Things like your individual car payments would be on you. (If your partner wants a Mercedes and you want a Ford, that’s their / your prerogative.) If you work from home and your partner doesn’t (or vice versa), maybe the WFH partner can kick in a few additional bucks for the internet / electric bill — especially if the non-WFH partner is commuting and spending $$$ on gas.

The other extreme would be to include any expenses that must be paid, no matter “whose” they are. Take student loans or credit card debt, for example. Say your partner has a much bigger balance — factoring those minimum payments into your joint account total can make your overall finances “fairer.” Sure, it’s their debt, but if all their “personal” money is going toward debt payments, they’ll have no money left for all the fun stuff you want to do together. (Boooooo.)

No matter how you choose to break it up, the most important thing is that you’re both on the same page about your finances — how much is coming in, how much is going out, and what long-term financial goals you want to hit together. Then make a plan to get there that works for you.